Why Trade Futures With Prop Firms

Learn how prop firms let you trade futures using firm capital, how evaluations work, how profit sharing is structured, and what rules you must follow to stay funded.

Why trade futures with prop firms

Prop firms let you trade futures using the firm’s capital instead of your own. You control larger buying power, follow clear rules, and keep a share of the profits. This model removes the need for large personal deposits while enforcing discipline.

How futures trading works at prop firms

When you trade futures through a prop firm, you place trades on contracts such as indices, commodities, or financial instruments. The firm provides the capital. You focus on execution, risk control, and consistency.

You trade real markets under real conditions. The only difference is who provides the capital.

The evaluation process

Before you access funded capital, most prop firms require you to pass an evaluation. This phase measures how you trade over time, not one lucky day.

What firms look for

- Respect for daily loss limits

- Control of trailing drawdown

- Consistent position sizing

- Stable performance over multiple sessions

If you break the rules, the evaluation ends. If you follow them and hit the profit target, you move to a funded account.

Trading with prop firm capital

After you pass the evaluation, you trade using the firm’s money. Losses are capped by predefined limits. You never owe the firm money beyond rule violations.

This structure lets you scale faster than personal accounts while keeping risk defined.

Profit sharing explained

Prop firms split profits between you and the firm. The exact split depends on the firm, but most offer traders the majority share.

You keep your percentage. The firm keeps the rest in exchange for capital, infrastructure, and risk coverage.

Benefits of trading futures with prop firms

No personal capital at risk

You do not risk your own funds beyond evaluation fees. This allows you to trade size without emotional pressure tied to personal savings.

Built-in discipline

Strict rules force better habits. You learn to manage drawdown, limit overtrading, and protect winning days.

Access to professional tools

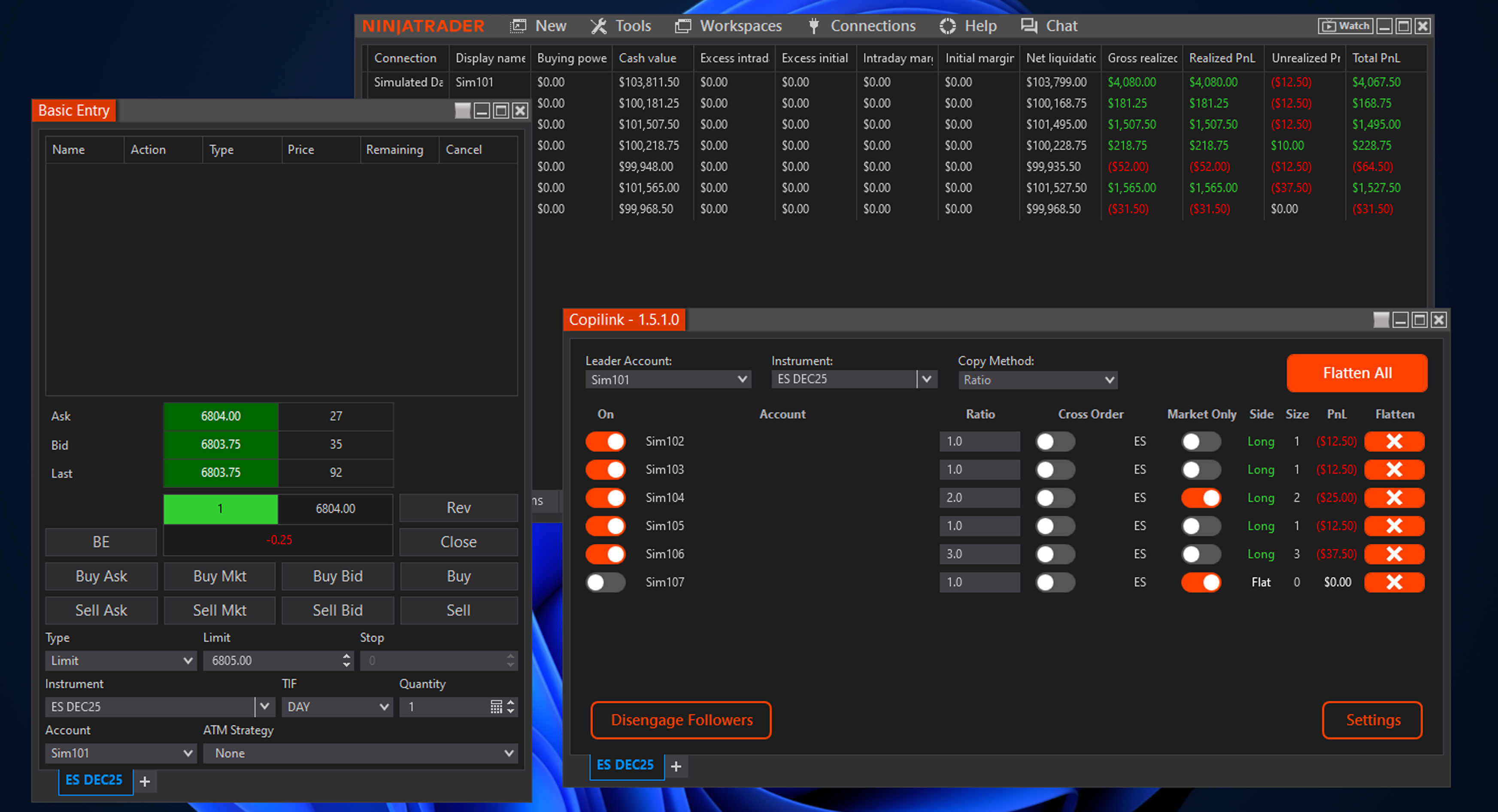

Most firms support platforms like NinjaTrader and Rithmic. You trade with professional-grade infrastructure.

Risk management expectations

Prop firms enforce rules automatically or through monitoring. You must stay within limits every day.

- Daily loss limits

- Trailing drawdown thresholds

- Consistency rules

- Session restrictions

Breaking these rules usually ends the account immediately.

Who prop firm futures trading is for

This model fits traders who already have an edge and want to scale without personal capital exposure. It does not suit traders who ignore risk rules or rely on oversized bets.

Final thoughts

Prop firms give you leverage, structure, and scale. In return, they demand discipline and consistency. If you follow rules and manage risk, prop firm futures trading offers a clear path to trading larger size without risking personal capital.

Related Articles

Tick Value Explained for Prop Firm Traders: The Number Behind Every Trade Decision

4 min readHow to Use Apex's Intraday Trailing Drawdown to Your Advantage With Smart Position Scaling

5 min readCL Crude Oil Trading on Prop Firm Accounts: What's Different and What to Watch For

5 min readReady to Start Trade Copying?

Try Copilink free for 7 days. No credit card required. Copy trades across unlimited prop firm accounts.