Risk Management

Sophisticated tools to protect your accounts and enforce disciplined trading with real-time monitoring and automated safeguards.

Daily Profit & Loss Limits

Set daily profit and loss boundaries that automatically flatten or disengage followers when hit.

Maintain strict daily discipline with automatic trade halts once profit or loss thresholds are reached. Copilink monitors each follower's session in real time, resetting limits automatically every new trading day.

Key Capabilities

- Optional auto-flatten or disengage on daily profit/loss trigger

- Optional lockout until next trading session

- Fully customiziable per follower account

Trailing Drawdown Tracking

Monitor account equity in real time with automatic peak tracking and drawdown enforcement.

Protect your funded and evaluation accounts with a live trailing drawdown tracker. The system automatically updates the high watermark and calculates remaining drawdown room, ensuring compliance with prop firm trailing rules.

Key Capabilities

- Tracks trailing drawdown dynamically by peak balance

- Manually set or-auto update account high watermark

- Live intraday drawdown distance display per follower

Evaluation & Account Goals

Define overall profit targets or evaluation goals with automatic position closure and disengagement.

Once the evaluation or profit goal is achieved, Copilink automatically halts trading. You can also apply a buffer to compensate for slippage or commissions, ensuring the system exits safely above the threshold.

Key Capabilities

- Auto-flatten at goal + configurable buffer

- Evaluation and funded mode compatibility

- Optional disengage on goal completion

Manual & Automatic Lockouts

Temporarily lock accounts from trading, manually or automatically, based on profit/loss outcomes.

Eliminate emotional trading and rule breaches. Accounts can be locked manually or automatically after profit or loss thresholds, staying inactive until the next market session (22:00 UTC).

Key Capabilities

- Manual one-click lockout control

- Auto-lockout on daily goal or loss trigger

- Unlocks automatically on next session reset

Consistency Enforcement

Ensure compliance with prop firm consistency rules using automated single-day profit caps.

Copilink enforces consistency by tracking your highest profit day and calculating a proportional cap based on your defined percentage. Once reached, the system can auto-flatten or disengage to maintain uniform daily performance.

Key Capabilities

- Tracks and updates highest profit day automatically

- Supports Evaluation and Funded accounts separately

- Reset consistency tracking after payout or restart

Session Persistence & Risk Sync

All risk configurations and metrics persist across restarts and synchronize between open tabs.

Every risk parameter-drawdown, goals, consistency, and lockouts-is automatically saved to disk and restored on launch. Session resets, payouts, and risk changes propagate instantly across all open Copilink tabs.

Key Capabilities

- Global per-account risk persistence

- Persistent data saved locally (no daily reset)

- Supports evaluation, funded, and live trading accounts

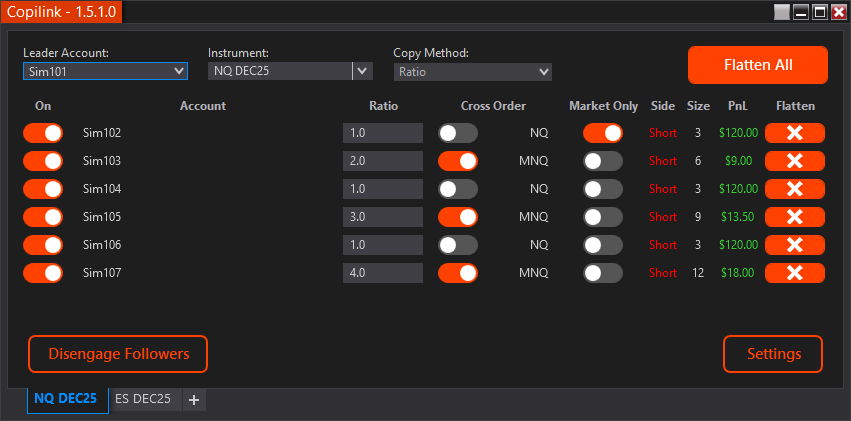

Unified Risk Dashboard

View and manage all risk parameters directly from the follower grid or detailed account panel.

Access every critical risk metric-daily loss left, drawdown remaining, goal progress, and consistency percentage-in one unified interface. All values update in real time as markets move.

Key Capabilities

- Centralized risk display for every account

- Real-time column updates across sessions

- Configurable visibility per metric column

Take Control of Your Trading

Implement risk management across all your trading accounts with real-time monitoring and automated protections.