Best Futures Trade Copier Software in 2025

A direct comparison of the best futures trade copier software in 2025, focusing on execution speed, prop firm compliance, and multi-account reliability.

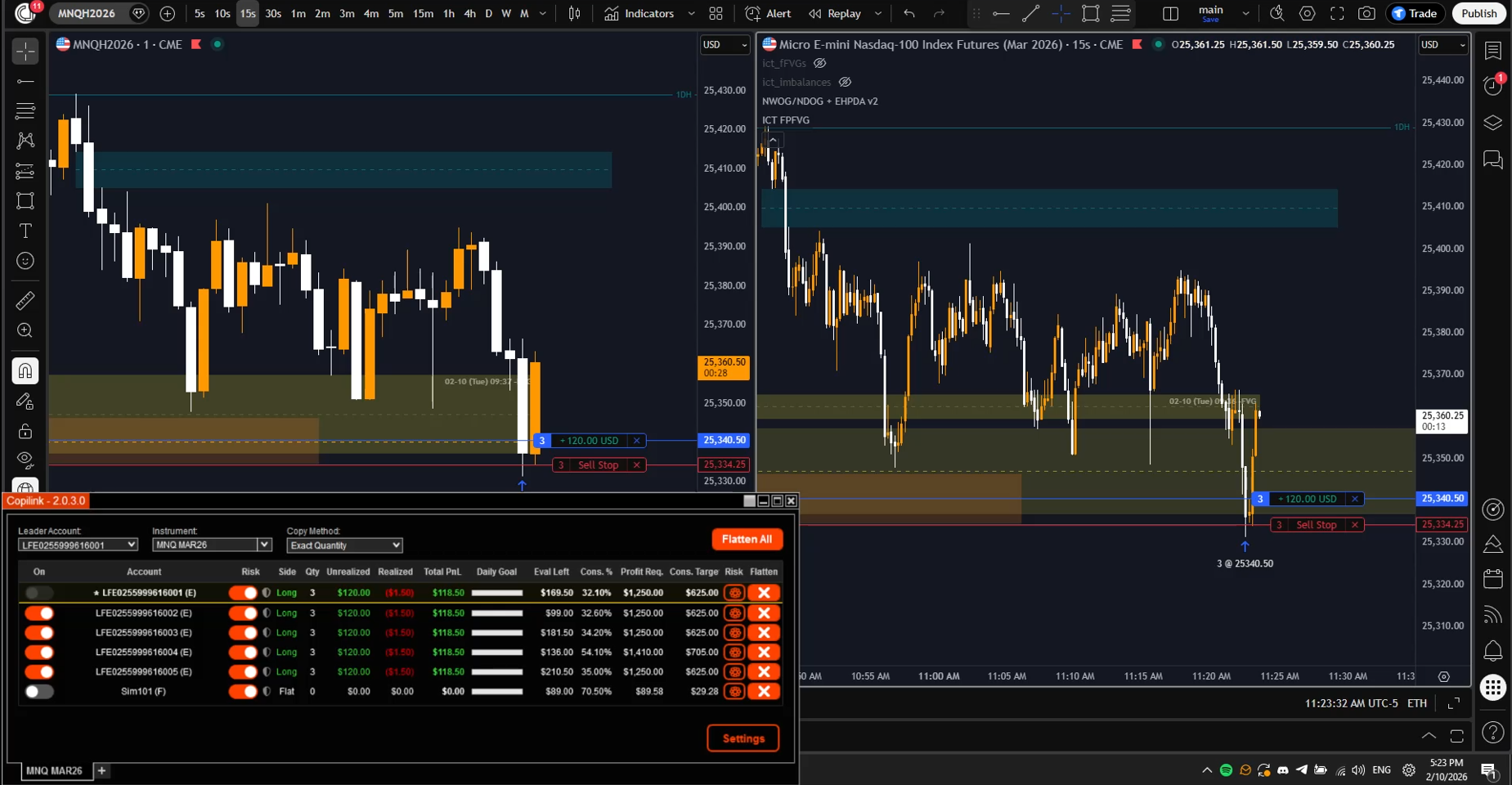

Best Futures Trade Copier Software in 2025

If you trade futures across multiple accounts, you need trade copier software that executes fast and stays reliable under pressure. You cannot afford missed fills, delayed replication, or rule violations.

This guide shows you what matters in 2025 and how to choose the best futures trade copier software for your setup.

What futures traders need from a trade copier

Execution speed

Speed controls your fills. In fast markets, even a 20 ms delay changes execution quality. Native trade copiers running inside your platform consistently outperform cloud-based systems.

Independent benchmarks from 2024 show local NinjaTrader-based copiers averaging under 5 ms, while cloud copiers range between 50 and 200 ms.

If execution matters to you, start with native solutions. This page breaks down execution speed in detail.

Account synchronization

You need deterministic behavior. Your followers must match your leader every time. Partial fills, rejected orders, and scaling errors cause immediate problems.

The best futures trade copier software keeps order state, quantity ratios, and instrument mappings in sync without manual correction.

Why prop firm rules change everything

Risk rules are not optional

Prop firms enforce daily loss limits, profit caps, trailing drawdowns, and consistency rules. Manual enforcement fails under stress.

A Futures Industry Association report from 2024 showed that over 40 percent of evaluation failures came from rule violations, not losing strategies.

You should use a trade copier with built-in risk controls. This risk management overview explains what to look for.

Consistency tracking matters

Many firms enforce consistency percentages. If one account runs ahead, you risk invalidation.

The best copiers track performance per account and enforce limits automatically. Cloud-based copiers rarely handle this well.

Native vs cloud futures trade copiers

Native copiers

Native copiers run inside your trading platform. They avoid external servers and network hops. You get faster execution and fewer failure points.

Most professional futures traders now prefer native systems. According to a 2025 FuturesTrader survey, 68 percent of multi-account traders switched away from cloud copiers.

Cloud copiers

Cloud copiers route orders through remote servers. This adds latency and increases failure risk during volatility.

They work better for cross-platform setups, not for NinjaTrader-focused futures trading.

What separates the best futures trade copier software

Persistent settings

You should not reconfigure accounts every session. Persistent settings save time and reduce mistakes.

Cross-instrument support

Many traders copy micros to minis. Your copier must map instruments correctly.

This trade copier overview explains cross-instrument scaling.

Real-time monitoring

You need visibility. The best tools show follower status, drawdown remaining, and risk state in real time.

Expert perspective

James Dalton, futures trading educator, said in a 2024 interview:

“Execution consistency beats strategy optimization. Most traders fail from poor infrastructure, not bad ideas.”

That applies directly to trade copying.

Frequently asked questions

What is the best futures trade copier software?

The best software executes with low latency, supports prop firm rules, and stays reliable during volatility. Native copiers outperform cloud systems for NinjaTrader users.

Are cloud trade copiers safe for futures?

They work, but they add latency and external dependencies. Most professional traders avoid them for fast futures markets.

Can trade copiers handle prop firm rules?

Only some. You need built-in daily loss limits, consistency tracking, and auto-flatten logic.

Do I need a trade copier for multiple evaluation accounts?

Yes. Manual execution increases error risk and slows reaction time.

Does execution speed really matter?

Yes. In futures trading, milliseconds change fills and drawdown behavior.

Next steps

If you trade futures seriously, your infrastructure matters. Choose software that protects execution and enforces rules automatically.

See how top prop traders structure their setups.

External references: Futures Industry Association, NinjaTrader.

Related Articles

Ready to Start Trade Copying?

Try Copilink free for 7 days. No credit card required. Copy trades across unlimited prop firm accounts.